How Realtors Can Use DISC Personality Training to Win More Clients

By David Delgado | Freedom Choice Lending 🧩 Why DISC Training Is a Game-Changer for Realtors In real estate, success isn’t just about market knowledge

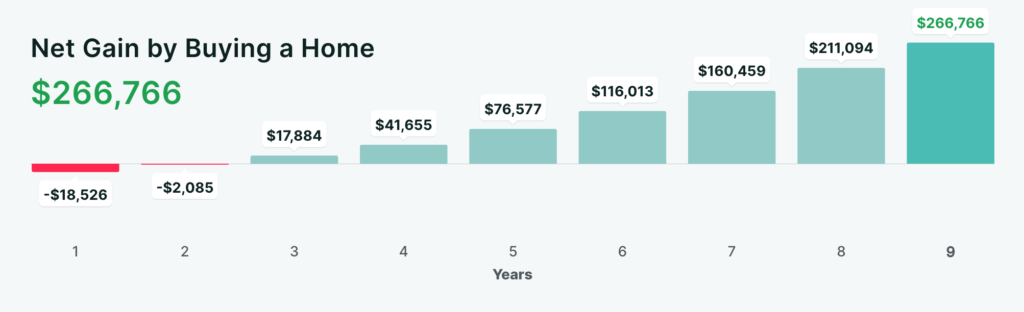

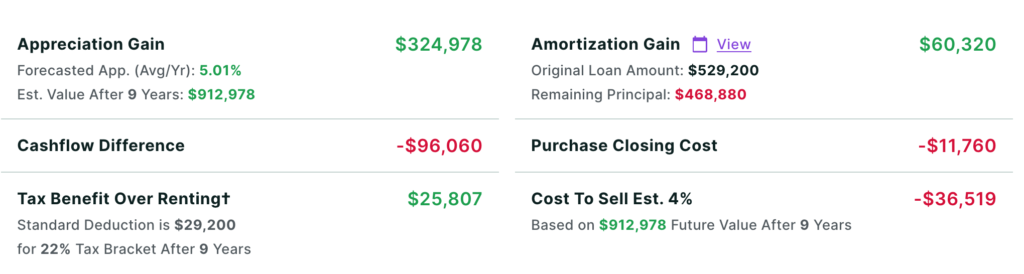

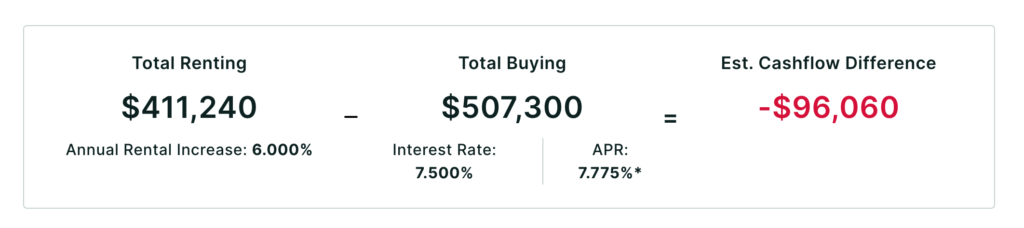

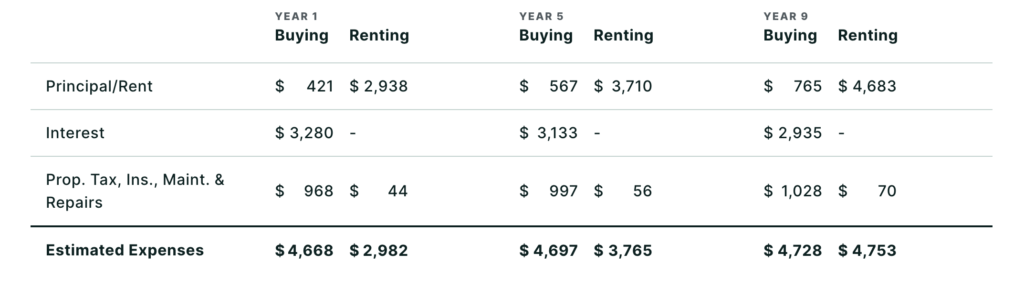

As a mortgage loan officer, I often get asked whether buying a home is a better financial decision than renting, especially in a competitive market like West Covina, California. With properties like 1788 Aspen Village Way on the market for $588,000, it’s important to weigh the pros and cons of buying versus renting, particularly when considering a long-term investment. In this blog, we’ll explore a nine-year comparison of buying versus renting, factoring in a forecasted annual appreciation rate of 5.01%.

1. Building Equity Over Time

One of the most compelling reasons to buy a home is the ability to build equity. As you make your monthly mortgage payments, a portion of each payment goes towards paying down the principal balance of your loan. Over time, this builds equity—the portion of the home that you own outright.

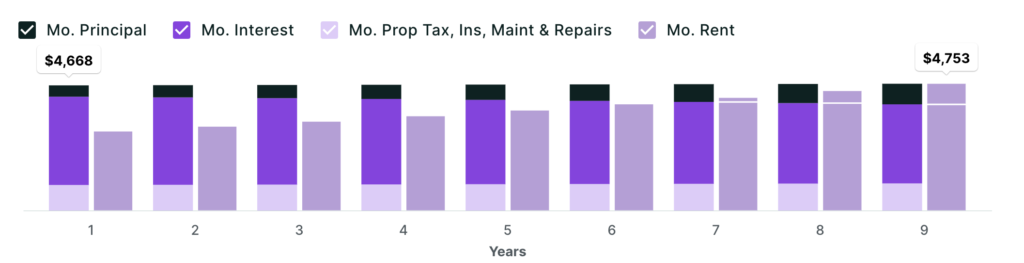

For example, with a purchase price of $588,000 and a standard 30-year fixed-rate mortgage at an interest rate of around 6.5% (assuming today’s rates), your monthly payment, including principal, interest, property taxes, and insurance, would be approximately $4,200. Over nine years, you’d pay around $453,600 in mortgage payments, of which $126,300 would go toward your principal, meaning you’d have that much equity in your home.

2. Home Value Appreciation

Given the current market conditions in West Covina, a forecasted annual appreciation rate of 5.01% over the next nine years is reasonable. With this appreciation, the value of 1788 Aspen Village Way could increase from $588,000 to approximately $912,362 over nine years. This significant increase in property value would further enhance your equity, making your home a valuable asset.

3. Tax Benefits

Homeownership offers several tax benefits, including the mortgage interest deduction and property tax deductions. These can significantly reduce your taxable income, saving you money each year. Over nine years, these savings can add up, making buying even more advantageous.

1. Flexibility

Renting offers flexibility that buying does not. If your job situation changes, or if you need to move for personal reasons, renting makes it easier to relocate without the complexities of selling a home.

2. Lower Upfront Costs

Renting typically requires a security deposit and the first month’s rent, which is significantly lower than the down payment and closing costs associated with buying a home. If you’re not ready to commit to a down payment of $58,800 (10%) or more, renting may be a better option for you.

3. No Maintenance Costs

When you rent, your landlord is responsible for most maintenance and repair costs. Homeowners, on the other hand, must budget for ongoing maintenance, repairs, and potential upgrades. Over nine years, these costs can add up.

Let’s take a closer look at the numbers over a nine-year period.

While the upfront costs and ongoing expenses of buying are higher, the equity built and the potential for property value appreciation significantly offset these costs. After nine years, you could potentially gain $324,362 in equity from the appreciation of your home, plus the equity built from your mortgage payments.

If you plan to stay in West Covina for at least the next nine years, purchasing 1788 Aspen Village Way could be a wise investment. The potential for building equity and benefiting from property appreciation outweighs the costs of renting in the long term. However, if flexibility and lower upfront costs are more important to you, renting may still be the better choice.

As always, the decision to buy or rent depends on your individual circumstances, including your financial situation, career plans, and personal preferences. If you’re considering buying a home, I recommend speaking with a mortgage professional to explore your options and get a clearer picture of what makes the most sense for you.

David Delgado

NMLS# 349079 • Freedom Choice Lending

Office: (562) 281-6163

1440 N Harbor Blvd, Fullerton, CA 92835

By David Delgado | Freedom Choice Lending 🧩 Why DISC Training Is a Game-Changer for Realtors In real estate, success isn’t just about market knowledge

By David Delgado | Freedom Choice Lending Why Most Agents Stay Busy but Don’t Move Forward If you’ve ever felt like your day is packed

Success in real estate doesn’t happen overnight.It’s not luck.It’s not the market.And it’s definitely not “who you know.” It’s what you do—every single day—that separates

💥 When a Deal Falls Apart, It Feels Personal — Because It Is If you’ve been in real estate for more than a few months,

Confidence is the invisible currency in real estate. You can have the best leads, the newest CRM, and the most polished marketing — but if

By David Delgado | Freedom Choice Lending Real estate is one of the most exciting—and one of the most challenging—careers you can pursue. The upside